Real Estate Budgeting – Creating Budgets for a Successful Real Estate Business

- July 14, 2020

- admin@ohi

You are focusing on your business and providing the best service possible to your clients and expanding your business, but are you successful? Your answer might be ‘yes’, of course, you are! But wait, having a great marketing strategy to take your business to the next level is only half the battle won. You also need to look into real estate budgeting to ensure complete success!

We share with you some ‘tricks of the trade’ to make sure you get your real estate budgeting right!

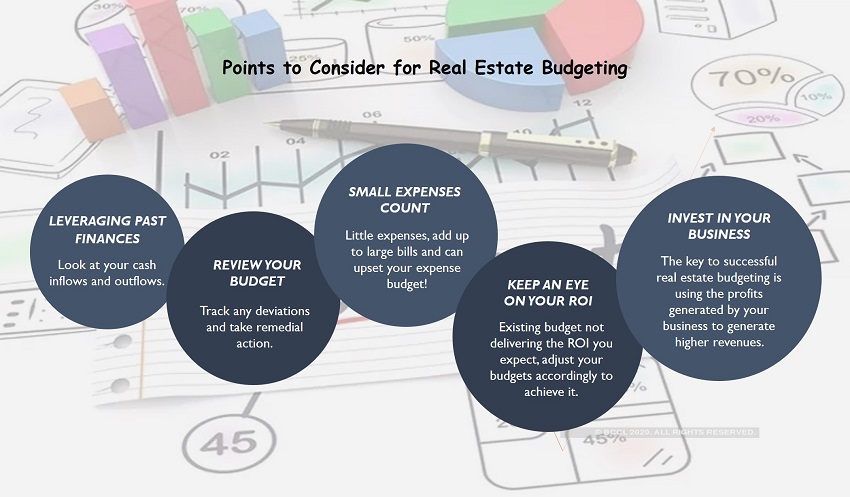

When it comes to real estate budgeting, you need to look at your cash inflows and outflows. Inflows are typically the revenues you earn in terms of commission, coaching, profit sharing from brokerage, or any other income you generate through referrals.

Your expenses would include those that can be directly related to running your business.

Your cash flow is the profit you make from your business. It is calculated after deducting your business expenses from your revenues. You need to pay taxes on this amount.

The starting point for real estate budgeting would be your official bank statement where both revenues and expenses related to your business are recorded.

The major heads for expenditure would be insurance, professional fees payable to accountants and other experts, office overheads, transportation, and advertising.

You can get accounting software to record all your transactions. Divide your expenses between fixed and variable components and try to trim down the wasteful expenditure in the variables section. Set aside funds for your expenses and both personal and professional taxes.

A quarterly review of your budget enables you to track any deviations and take remedial action. This is an important part of real estate budgeting as you find out the underperforming departments and those products which are doing better than others. You can divert more funds to departments that are performing well so that there are no supply issues.

The products you find not performing can be handled either with more targeted marketing, training, or both. This will ensure the optimal allocation of funds.

This will also help you find out if you need to automate your accounts payable and accounts receivable so that your creditors receive their payments on time and you don’t miss collections from your debtors.

You can also determine the percentage to which you need to increase your sales to meet your sales budget or by what percentage your need to reduce your expenses to meet your overhead budget.

When it comes to real estate budgeting, every dime counts! So the next time you decide to spend on a relatively cheap advertising campaign, think twice. When you add all those ‘little’ expenses, they add up to quite a ‘large bill’ at the end of the year and can upset your expense budget!

There are some questions you need to ask yourself every time you need to shell out any money. Have you checked the credentials of the agency? Do they have expertise in the target audience niche that you are looking at? Considering your overall marketing strategy, how much value will this campaign add to it?

Even if you are test marketing your product with a small budget to a particular niche that involves a potential customer section, you should find out if the marketing agency understands the metrics involved. They should have clear deliverables and be accountable to you if those promises are not delivered.

The goal of real estate budgeting is to get you the desired return on investment or ROI. If you find that your existing budget is not delivering the ROI you expect, then you need to adjust your budget accordingly to achieve it.

As a rule of thumb, if there is an expense without a corresponding income, then you need to eliminate it. Not only should you monitor your expenses and marketing strategies regularly, but you also need to find out which of these are generating a larger share of your revenues.

If you find that you find that a particularly expensive marketing strategy is yielding higher than expected revenues, then this expense is a productive one. You also need to find out the social media channels that your target audience spends most of their time on by hiring a digital marketing agency. This will help you develop a more focused marketing strategy that generates higher ROI.

Social media also helps in the generation of leads since the conventional marketing strategies try to spread awareness among a broader group of people, and this does not work in this day and age. You need to keep in mind that one strategy doesn’t fit all when it comes to real estate budgeting.

What works for your competitor might not work for you. You should have answers to questions like who is my target audience? What social media platform do they use the most? What kind of customized mobile app do I need to engage my target audience better?

Keeping yourself updated about the latest digital marketing tools and understanding your business requirements well helps in effective investment versus wasteful expenditure.

The best source of funds to use for investing in the growth of your business would be your profits! Create budgets for your personal life as well and cut out all non-essential expenditure. The key to successful real estate budgeting is using the profits generated by your business to generate higher revenues.

This creates a healthy cycle where your business expansion is funded by the business itself. The dual benefit, in this case, would be meeting the expense budget comfortably and not having to take any loans that involve high interest rates. This will ensure that your business is debt-free.

Apart from investing the profits, you also can focus on business growth and development by outsourcing tasks that don’t generate any revenues. You will save on overheads, and this will add to your profits. You pay fees to these professional firms, and they take care of all accounting responsibilities.

If you want to succeed as a real estate agent, start real estate budgeting now. The reason for this is that real estate budgeting allows you to focus on what is important for the business and you start allocating funds to the high-revenue generating areas of your business!

Hire a professional firm to organize a real estate budget and forecasting watch your profits soar!

OHI is a fifteen-year-old real estate services company working with 50+ commercial and residential real estate developers, funds and property management companies across USA. Our deep expertise in real estate accounting, financial analysis, lease administration and asset management has helped clients cut associated costs by 40-50%. We currently provide these services to a portfolio of 75000 units across clients.

We invite you to experience finance and accounting outsourcing through us.

Low Cost Asset Management Services for Real Estate Investment Firms: Property & Portfolio Level Dashboards | Cash Flow Projections | Asset Level Budgets – VIEW MORE

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.