The Role of an Outsourced Accounting Service Provider during COVID-19

- July 31, 2020

- admin@ohi

The global pandemic, COVID-19, has impacted companies of every size as they are trying their level best to contend with economic and health challenges. Companies across the globe are operating as remote firms, working virtually from their homes, in an attempt to storm through this financial crisis that has resulted as an outcome of the viral outbreak.

Accountants, at this point, are burning out with the excessive workload. The new normal of working from home and managing remote accounting teams is taking a heavy toll on companies trying to manage their year-end accounts, bookkeeping, accounts management, and more. The best solution is to share the workload with an external outsourced accounting service provider during these turbulent times.

Every sector of commerce is being forced to undergo a refurbishment and reinvention process of their product offerings at an unanticipated pace. Reacting to this unpredictable market scenario, businesses need to evolve their day-to-day operations and face this new challenge with precision and control. Where physical office spaces are closed, maintaining effective financial operations has become a huge challenge, especially for businesses with large internal accounting departments that operate with in-person workflows and rely more on physical documents than anything else. Hence, the only viable solution that can revive and enhance financial operations is hiring an outsourced accounting service provider.

An outsourced accounting service provider with the right technology and a dedicated team of accountants can serve your business during this pandemic in the best possible manner. They ensure consistent client services through work-from-home arrangements for all their employees who take care to deliver you their services within the stipulated time.

Shelter-in-place restrictions have been imposed in many communities due to the COVID-19 pandemic. Due to this, many businesses have shut down their offices. However, business processes must continue irrespective of revenues or cash collections being slow. Financial accounting is paramount. Therefore, under these circumstances businesses should consider outsourced their accounting activities. A well-established outsourced accounting service provider will be well equipped and stably positioned to keep their operations running smoothly, despite local restrictions.

Every business is facing the brunt of an economic disaster, and by outsourcing services like accounting, they can cut down on their operational expenses to a great extent by availing low cost services with their outsourced partners. They do not have to spend in-house, and hence many day-to-day expenses can be done away with, thereby providing room for better utilization of the saved amounts.

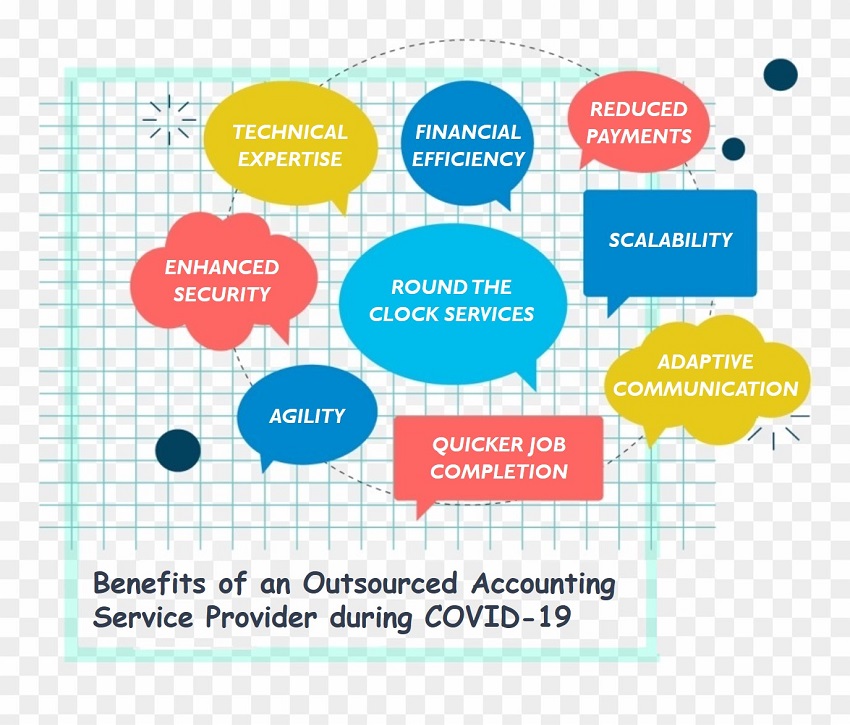

Small businesses have been wrecked by the Coronavirus pandemic. The competitive landscape post-pandemic is surely going to take a new turn. For businesses open to adapting, it would render them quick rebounding and eventual growth. The result would be the positioning of these small businesses in a unique short-term landscape with reduced competition. This agility would act as a catalyst for business success and growth. Here the role of an outsourced accounting service provider would turn the tables in favor of small businesses that believe in flexibility and are ready to go with the flow in the long run.

Businesses are losing a lot on their accounting back-office work, and a lot of back-log is being created due to the present pandemic situation. In such circumstances, seeking help from an outsourcing accounting agency is the best option to keep your accounts updated and managed correctly and efficiently.

Organizations availing of outsourced accounting services enjoy a high degree of scalability that can position them to seamlessly deal with complexities associated with acquisitions and mergers. Additionally, its tax-planning teams, in-house merger, and acquisition can provide expertise, which in turn would accelerate opportunities, enhance synergies, and help them navigate opportunities even in remote work environments.

The accounting industry contains sensitive financial information that needs to be protected and kept secure at all times. Despite the growing number of data breach cases, most of the businesses cannot afford to install expensive, high-security accounting software on their systems. Outsourced accounting providers are highly professional, and they invest in security technologies and infrastructure to safeguard their clients’ financial data against any kind of data breach attempt.

Applications like GoToMeeting, Zoom, Skype, and Teams have accelerated technology-based communication. They have replaced physical meetings with virtual ones that are here to stay as long as this pandemic lasts. This technological trajectory is being experienced by the finance and accounting outsourcing industry as well, which is delivering satisfactory results for businesses all over the world.

Your outsourced accounting service provider should possess technical expertise. It should be competent enough to sail you through the unprecedented volume of new rules, regulations, loan options, income tax changes, etc., which have been incorporated recently. Businesses have to rely on their trusted advisors’ expertise, more than anything else, to get their way out with these complexities in the present pandemic scenario.

There are a plethora of tasks, which need to be handled when it comes to managing back-office operations. However, it is not humanly possible to work round-the-clock to complete these pending tasks at hand. In this case, it is advisable to hire an accounting team from an outsourced accounting service provider that can work in different time zones and complete the work in a hassle-free manner, within the stipulated time frame.

If we go by statistics, 78% of companies across the globe are happy with outsourcing their accounting needs to an outsourced accounting service provider. With the pandemic situation showing its colors in full swing, there is no certainty of things getting back to normal anytime soon. Even in such circumstances, companies need to keep their accounts updated to ensure business growth and management. However, in the absence of their in-house accounting team, the need of the hour is to seek help from a professional outsourced accounting service provider that can ensure complete dedication and consistency in delivering client services even during these challenging times.

OHI is a specialized finance and accounting outsourcing service provider with over fifteen years of finance and accounting outsourcing experience. We have strong functional outsourcing expertise in end to end accounting processes covering daily accounting activities, reconciliations, month end and year-end account finalization processes, employee reimbursements, payroll processing, management reporting and financial analysis.

OHI serves close to 300+ clients across USA, UK and Canada. We invite you to experience finance and accounting outsourcing through us.

Learn More About Our Accounting Services for Small Mid Size Businesses: AP | AR | Reconciliations | General Accounting | Month End Closing | Financial Reporting – VIEW MORE

Contact us for a customized NO OBLIGATION proposal for outsourcing your accounting activities.